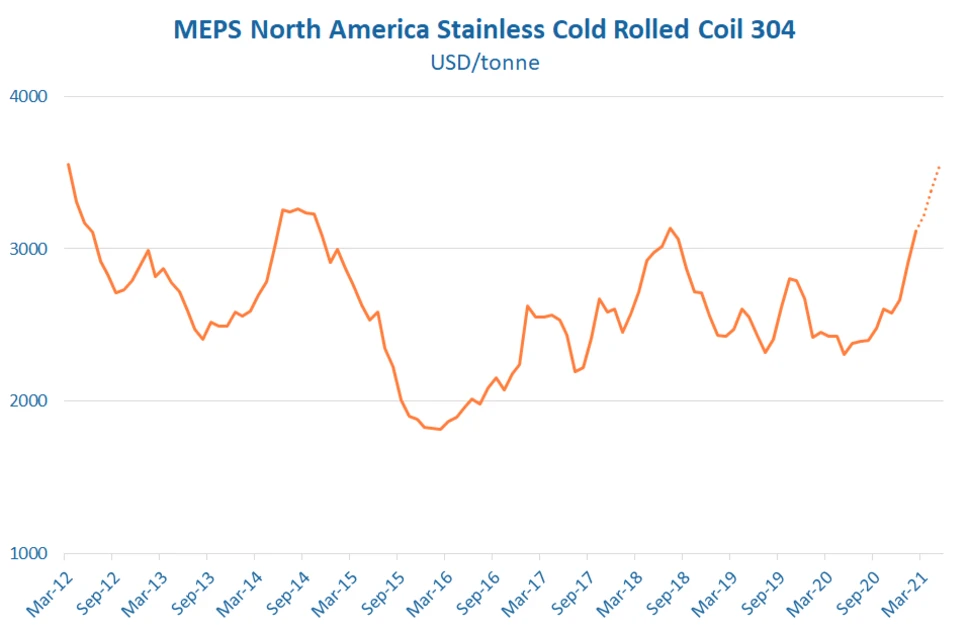

US stainless steel prices forecast to reach 9-year high

The past twelve months were a turbulent time for all those involved in the US stainless steel market. In a dramatic turnaround, the unprecedented pandemic-induced slump in steel requirements was superseded by strong demand, stock shortages and soaring prices.

Many industrial sectors witnessed a rise in new orders during the final few months of 2020. Consequently, factories began to boost their output. The IHS Markit US Manufacturing PMI rose to 59.2 in January – its highest level since the indicator began.

The unexpectedly quick recovery in demand resulted in supply chain bottlenecks. Moreover, the rebound in activity is leaving manufacturers, in the automotive, white goods and agricultural segments, short of material and parts to maintain their production schedules.

Shortages start to bite

The surge in demand during the past few months has led to uncharted territory for many US stainless steel market participants. Months of destocking, during the height of the pandemic, followed by such a rapid uptick in demand, quickly depleted distributors’ inventories. This was most notable in 300 and 400 series coil products, destined for the automotive and white goods sectors.

Numerous stainless steel buyers report that their inventories are at their lowest for many years. The extraordinarily long delivery lead times offered by the US mills are resulting in delayed customer supplies. Furthermore, local steelmakers are refusing requests for additional material, as they attempt to manage their order books.

The recent adverse weather conditions in parts of the US have caused further disruption to the already struggling supply chain. Companies in the worst affected areas comment that they have lost one week of normal business activity.

High container costs, coupled with the ongoing Section 232 tariffs, continue to deter imports. However, with such tight conditions in the domestic market, US buyers are becoming increasingly interested in procuring material from overseas suppliers, even at a higher cost than local supply.

Prices highest since July 2018

Supply-related bottlenecks are driving up prices throughout the supply chain. Steelmakers are faced with rising input costs, which are demonstrated by ever-increasing alloy surcharges. Daily nickel values continue to strengthen, due to the latest round of electric vehicle hype, and supply concerns.

Global logistical difficulties, especially with shipments from Chile, led to a surge in molybdenum prices, in the past few weeks. Furthermore, recent gains in the spot market value of chromium are likely to result in a significant rise in the second quarter contract figure. Moreover, stainless steel scrap prices are increasing.

In addition to the upturn in alloy surcharges, US stainless steel producers have reduced their price discounts three times during the past six months. Consequently, transaction values for stainless cold rolled coil are now at their highest levels since July 2018.

The shortage of material within the distribution sector is enabling sellers to pass on these increases to end-users. Those companies which have high stocks report that now is the time to make windfall profits.

Further rises on the horizon

Alloy surcharges are likely to increase further in the next few months, driven by rising raw material costs. Moreover, local mills are expected to push for additional reductions in the discount levels applied to basis figures. This is forecast to result in cold rolled coil, grade 304, transaction values climbing to a nine-year high, in the second quarter of 2021.

Shortages are expected to remain a feature of the market, in the near term, particularly for ferritic material. ATI’s withdrawal from commodity coil production is to be delayed until the end of this year. However, the company is, reportedly, producing for outstanding contracts only, at present.

Pressure is growing on the US government and President Biden, to modify or remove the Section 232 tariffs. Any adjustments could result in an increase in import competition and a reduction in domestic stainless steel prices.

Source:

Stainless Steel Review

The MEPS Stainless Steel Review is an invaluable monthly guide to international stainless steel prices and includes the latest global stainless steel industry analysis.

Go to productRequest a free publication