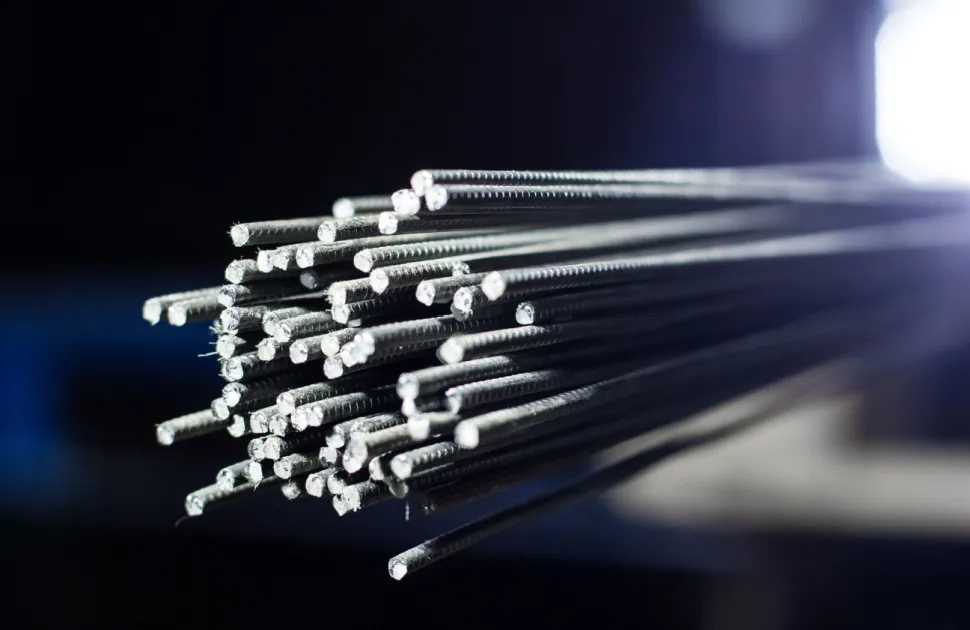

US longs prices fail to pick up despite rising costs

Price trends in the US long product segment traditionally do not scale the heights or plunge to the depths of those for flat rolled steel. The relative calm in this area is a welcome relief to market participants.

Buyers in the United States can make purchasing decisions with a degree of confidence. This helps steel manufacturers to undertake long-term investments. Both parties assume that domestic values will, generally, fluctuate within a narrow band.

Conversely, US flat product customers have had to contend with periods of extreme price volatility, during the past five years. A wide range of factors are behind this, including the introduction of Section 232 legislation, the impact of a global pandemic, and the repercussions from the outbreak of war in Europe.

US purchasing managers of strip products often compare the price dynamics to a rollercoaster ride. Steel users may expect the longs sector – which is exposed to many of the same external pressures – to behave in a similar fashion. However, historical long product prices are relatively stable in comparison.

The results of MEPS’ US research, in January, are an example of this. Following a lengthy period of deterioration, flat product prices are starting to escalate, once again. A series of mill list hikes have gained traction in the market. Basis values are expected to rise further during the first quarter.

An increase in scrap costs, in both December and January, has been a contributory factor in the latest ascent. Despite scrap being the main expenditure in the production of many long products, few price movements were reported for beams, bars and rods in the past four weeks.

A slowdown in activity at this time of year was anticipated. Demand from the residential building sector has reduced considerably. The Federal Reserve’s decision to raise interest rates, in an attempt to cool inflation, is weighing heavily on the domestic housing market. Conversely, other construction-related segments are performing relatively well.

A backlog in commercial building projects supported activity levels for much of 2022. The prospect of a number of significant public infrastructure schemes being approved should support demand in 2023.

Order intake, at mill and stockholder level, remains reasonable, compared with that witnessed in other parts of the world. It is believed that further rises in scrap expenditure may even be the prelude to price increases for long products, in the coming months.

The mills’ price ambitions are likely to be supported by a lack of supply alternatives, from overseas. Owing to rises in international steel values, import price offers, into the United States, have increased in recent weeks.

The advantage of procuring material from non-North American outlets, rather than local mills, has narrowed considerably. Imported volumes are likely to hold little appeal, currently. Existing trade legislation and the relatively long delivery times being quoted by foreign producers are discouraging factors.

However, US long steel manufacturers are expected to struggle to implement large price hikes, especially in the winter months. Domestic supply for most products remains readily available. This is despite recent production outages during the holiday period. Most common sizes are available from mill stocks or from the next scheduled rolling.

Purchasing managers are keen to highlight that prices of rebar and long products are at historically high levels. With recessionary concerns in the United States and around the world persisting, it is likely that long product values will come under negative pressure for most of this year.

Source:

International Steel Review

The MEPS International Steel Review is an essential monthly publication, offering professional analysis and insight into carbon steel prices around the world.

Go to productRequest a free publication