Regional stainless steel flat product prices reach multi-year highs

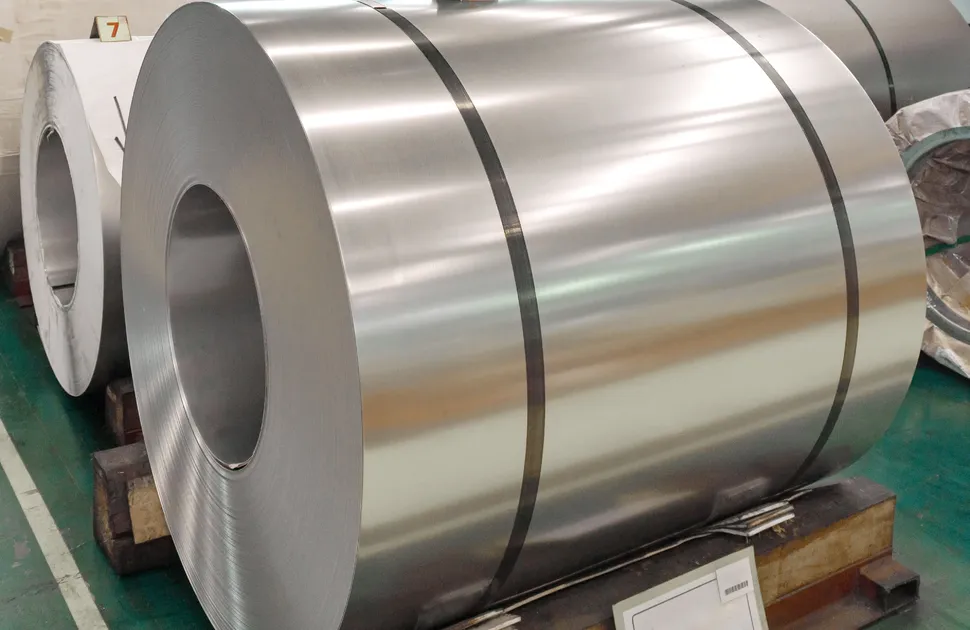

Global stainless steel prices continued to strengthen in early March, most notably for 300 series coil and sheet. The upward trend is supported by healthy demand, severe material shortages, and extended delivery lead times for replacement tonnages. This, combined with strong raw material costs, has pushed prices to multi-year highs, for these products, in Asia, Europe and the US.

Asian selling figures increased at the beginning of March. However, the significant drop in nickel costs during the first week led several steelmakers to make downward adjustments to their prices in the middle of the month. Nevertheless, the MEPS Asian average transaction values, for March, stand at their highest levels since mid-2014. Many export offers to European customers fell by around US$100 per tonne, in recent weeks. However, several Asian producers are reportedly preferring to supply their own markets, rather than take orders from overseas buyers.

In Europe, further price increases were recorded for stainless steel flat products, this month. The MEPS European average transaction value for 304 cold rolled coil, in March, stands at €2671 per tonne. This is a price level not achieved by the European stainless producers since June 2011. Supply remains tight across the region. Delivery lead times are extended, with a number of mills fully booked into the summer months. Imports of cold rolled material remain subdued, pending the results of the European antidumping investigation into material of Indian and Indonesian origin.

The MEPS North American average transaction value for type 304 cold rolled coil increased by US$70 per tonne, this month. Demand continues to outstrip supply. Consequently, distributors and traders are unable to build stocks, and inventories remain low across the region. Furthermore, a shortage of truckers has resulted in substantial increases in transportation costs. Deliveries of material from overseas suppliers remain restricted by the Section 232 tariffs, intensifying the apparent shortage of stainless steel.

The fundamentals of the nickel market have brought that metal’s price down to a more sustainable level, for now. Nevertheless, the medium-term outlook for nickel remains positive and an imminent price crash is not envisaged. Therefore, stainless steel coil and sheet transaction values are expected to remain elevated, in all regions, in the near future. Furthermore, tight availability and relatively strong demand, in the stainless steel market, are forecast to persist.

Source:

Stainless Steel Review

The MEPS Stainless Steel Review is an invaluable monthly guide to international stainless steel prices and includes the latest global stainless steel industry analysis.

Go to productRequest a free publication